Start Investing For Retirement With Fidelity Today!

Are you ready to secure your financial future? Investing for retirement with Fidelity offers a powerful path to long-term financial security, providing access to a wide array of investment options, expert guidance, and innovative tools designed to help you achieve your retirement goals.

The journey toward a comfortable retirement is a marathon, not a sprint. It requires careful planning, consistent effort, and a strategic approach to investing. Fidelity, a well-established and respected financial services company, provides a comprehensive platform to empower individuals to take control of their financial destiny. From seasoned investors to those just starting, Fidelity offers resources and solutions tailored to different needs and risk tolerances. The landscape of retirement planning can appear complex, with various investment vehicles and strategies to consider. This article delves into the core aspects of investing for retirement with Fidelity, exploring the benefits, investment choices, and essential strategies to help you build a robust financial foundation for your golden years. This examination focuses on how Fidelity's tools, guidance, and resources can be effectively utilized to navigate the complexities of retirement investing and to maximize your potential for financial success.

One of the primary advantages of investing for retirement through Fidelity is the breadth of investment options available. Fidelity provides access to a vast universe of mutual funds, exchange-traded funds (ETFs), individual stocks, bonds, and other investment products. This extensive selection allows investors to diversify their portfolios, manage risk, and customize their investment strategies to align with their individual goals and risk profiles. Whether youre looking for growth stocks, dividend-paying investments, or a mix of assets, Fidelity's platform offers a diverse range of choices to construct a well-balanced portfolio. Fidelitys fund offerings include actively managed mutual funds, which are overseen by professional portfolio managers who make investment decisions based on market conditions and research, and passively managed index funds that track specific market indexes, offering a cost-effective way to gain exposure to a broad market segment. ETFs provide similar diversification benefits to mutual funds but trade on exchanges like individual stocks, providing additional flexibility for investors.

Fidelity also offers a wide range of accounts designed specifically for retirement savings. These include traditional IRAs and Roth IRAs. Traditional IRAs allow for pre-tax contributions, meaning that contributions may be tax-deductible in the year they are made, and the investment grows tax-deferred until retirement. In retirement, withdrawals are taxed as ordinary income. Roth IRAs, on the other hand, feature after-tax contributions, meaning that contributions are not tax-deductible, but qualified withdrawals in retirement are tax-free. The choice between a traditional and Roth IRA depends on an individuals tax situation and long-term financial goals, and Fidelity offers support to help investors make the appropriate decision. In addition to IRAs, Fidelity also provides access to employer-sponsored retirement plans, such as 401(k)s and 403(b)s. These plans are often offered by employers as a benefit and allow employees to contribute a portion of their pre-tax or after-tax income to a retirement account. Many employers also offer matching contributions, which can significantly boost an employee's retirement savings.

Beyond investment options, Fidelity provides a wealth of educational resources and tools to assist investors in making informed decisions. The Fidelity website and mobile app offer educational articles, videos, webinars, and interactive tools that cover a wide range of investment topics. These resources are designed to help investors understand the basics of investing, learn about different investment strategies, and stay informed about market trends. Fidelity also offers personalized financial planning services. These services range from basic financial planning tools to comprehensive financial planning advice from experienced financial advisors. Financial advisors can help you assess your current financial situation, set retirement goals, develop an investment plan, and monitor your progress over time. They can provide guidance on asset allocation, investment selection, and risk management, helping you navigate the complexities of retirement planning with confidence. Fidelitys financial planning services are offered through various channels, including in-person meetings, phone consultations, and online platforms, to cater to different preferences and needs.

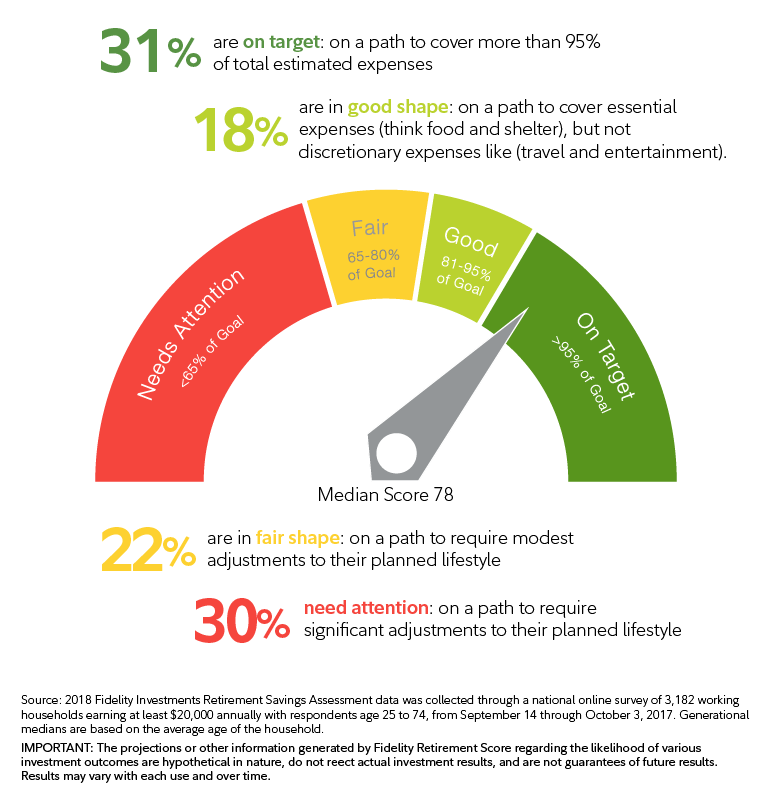

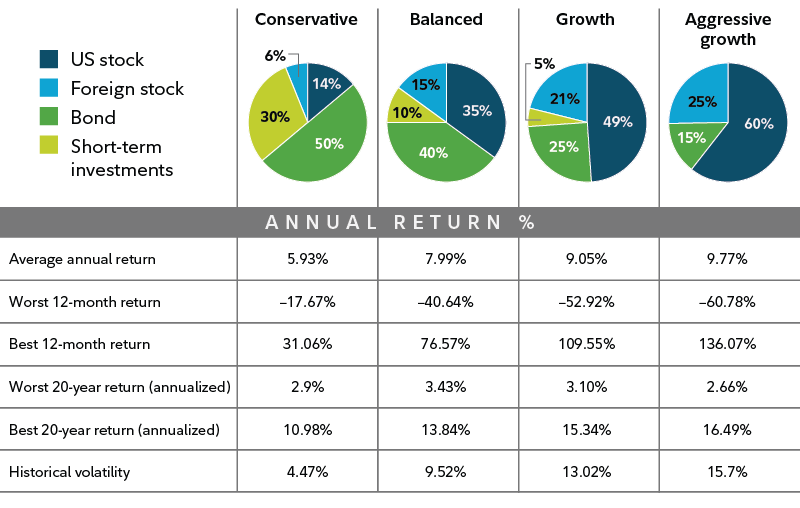

One of the critical elements of successful retirement investing is asset allocation, which is the process of distributing your investment portfolio across different asset classes, such as stocks, bonds, and cash. Asset allocation is a fundamental determinant of your portfolio's overall risk and return. Fidelity offers various tools and resources to help investors determine the optimal asset allocation for their individual circumstances. These tools often consider factors like age, risk tolerance, time horizon, and financial goals to provide personalized recommendations. Fidelity's asset allocation tools may include risk questionnaires, model portfolios, and asset allocation calculators that provide guidance on how to diversify your portfolio. The general principle is that younger investors with a longer time horizon can typically afford to take on more risk and invest a larger portion of their portfolio in stocks, which have the potential for higher returns. As investors approach retirement, they often shift their asset allocation towards more conservative investments, such as bonds, to preserve capital. Fidelity's investment professionals can help adjust the asset allocation as needed, making sure the investments are well suited to the current situation.

Another essential aspect of retirement investing is the importance of long-term perspective. Retirement is a long-term goal, and it's crucial to avoid making impulsive investment decisions based on short-term market fluctuations. Market volatility is a natural part of the investment cycle, and it is essential to stay the course and resist the temptation to sell investments during market downturns. Historically, markets have always recovered from downturns, and investors who remain invested often benefit from the eventual rebound. Fidelity's resources and tools are designed to help investors maintain a long-term focus and make rational investment decisions. This includes educational content on market cycles, investment strategies, and the importance of staying disciplined. Fidelity also offers tools to help investors track their progress, monitor their portfolio performance, and stay on track with their retirement goals. Regular monitoring and portfolio reviews are essential to ensure that your investment strategy aligns with your evolving needs and goals.

The role of fees and expenses in retirement investing should not be underestimated. Fees and expenses can significantly impact your investment returns over time. Fidelity is committed to offering competitive pricing and providing transparent information about the fees associated with its investment products and services. Investors should understand the different types of fees, such as expense ratios for mutual funds and ETFs, trading commissions, and advisory fees. These fees can vary depending on the type of investment product, the account type, and the level of service provided. It's essential to compare fees across different investment options and choose those that are cost-effective. Fidelity's platform provides information on the fees associated with each investment product, allowing investors to make informed decisions. Transparency and clear disclosure of fees are key components of Fidelity's commitment to helping investors achieve their financial goals. It allows investors to assess the costs associated with various investment choices, ensuring that they can evaluate the value they receive for the fees paid.

Rebalancing your portfolio at periodic intervals is a crucial part of portfolio management. As market conditions shift, different asset classes may perform differently, causing your portfolio's asset allocation to drift away from your original target. Rebalancing involves selling some investments that have performed well and buying investments that have underperformed to bring your portfolio back to its desired asset allocation. This process helps to maintain your desired risk level and can also potentially enhance returns. Fidelity offers tools and resources to help investors rebalance their portfolios. These include asset allocation calculators, portfolio tracking tools, and alerts that notify investors when their portfolio's asset allocation deviates from its target. Fidelity advisors can also help to guide the rebalancing process, offering advice on when and how to rebalance your portfolio to align with your retirement goals. The frequency of rebalancing may vary depending on individual circumstances, market conditions, and the investor's risk tolerance.

Tax efficiency is another vital consideration in retirement investing. Taxes can erode your investment returns over time, and it's essential to minimize the impact of taxes on your portfolio. Fidelity offers a variety of tax-advantaged accounts, such as IRAs and 401(k)s, which can help to reduce your tax burden. Investors should also consider the tax implications of their investment decisions, such as the tax treatment of dividends, capital gains, and withdrawals. Fidelity provides educational resources and tools to help investors understand the tax implications of their investments. This includes information on tax-efficient investing strategies, such as investing in tax-advantaged accounts, tax-loss harvesting, and strategic asset location. Tax-loss harvesting involves selling investments that have lost value to offset capital gains, which can reduce your tax liability. Strategic asset location involves placing different types of investments in the most tax-efficient accounts. It is a tool that can help minimize the taxes paid on investments. Fidelity offers guidance on the appropriate location of investments based on the type of account and the nature of the investments themselves. The combination of these practices forms a cohesive approach to help investors optimize after-tax returns.

Regularly reviewing your investment strategy and making adjustments as needed is crucial for ensuring that you stay on track with your retirement goals. Retirement planning is not a one-time event; it's an ongoing process that requires continuous monitoring and evaluation. Circumstances change over time, including your age, risk tolerance, financial goals, and market conditions. It is important to update your investment strategy regularly to reflect these changes. Fidelity offers tools and services to help investors review their portfolios and make adjustments as needed. These include financial planning tools, portfolio tracking tools, and access to financial advisors. Fidelity's advisors can help you review your investment strategy, assess your progress, and make recommendations for adjustments. This can involve adjusting your asset allocation, changing your investment selections, or revising your contribution levels. Periodic reviews are essential to ensure that your investment strategy aligns with your evolving needs and goals, helping you stay on course for a successful retirement.

Beyond the traditional investments, Fidelity also recognizes the evolving financial landscape and offers resources in areas such as Environmental, Social, and Governance (ESG) investing and the growth of digital assets. For investors interested in incorporating social and environmental considerations into their investment decisions, Fidelity provides a range of ESG-focused investment options. These options allow investors to invest in companies that align with their values, supporting sustainable business practices and promoting positive social change. Fidelity's ESG offerings include mutual funds, ETFs, and other investment products. It is designed to allow investors to align their portfolios with their personal values. Fidelity also recognizes the growing interest in digital assets, such as cryptocurrencies. Fidelity has begun to offer access to certain digital asset-related products and services. It also provides educational resources to help investors understand the risks and opportunities associated with digital assets. This forward-looking approach highlights Fidelity's commitment to adapting to changing market trends and providing investors with access to the evolving financial landscape.

Retirement investing with Fidelity offers many benefits. It includes a wide array of investment choices, expert guidance, educational resources, and cutting-edge tools designed to help individuals achieve their retirement goals. By understanding the fundamentals of retirement investing, leveraging the resources available, and adopting a long-term perspective, investors can build a robust financial foundation for their golden years. The success of investing for retirement is contingent on a comprehensive approach encompassing asset allocation, risk management, cost awareness, portfolio rebalancing, tax efficiency, and regular reviews. Fidelity's commitment to providing comprehensive solutions, personalized advice, and a user-friendly platform makes it a valuable partner for those seeking to secure their financial future. The key to successful retirement investing lies in a well-defined plan, consistent execution, and the ability to adapt to changing circumstances. Fidelity is uniquely positioned to help you navigate the complexities of retirement planning. It is a partner in your journey towards financial security and a comfortable retirement.