Fidelity Retirement Planning Advice

Are you diligently saving for retirement, only to feel a gnawing uncertainty about your future financial security? Fidelity Retirement Planning Advice offers a beacon of clarity in the often-turbulent waters of retirement preparation, empowering you to navigate the complexities of financial planning with confidence and achieve your long-term goals.

The journey to a comfortable retirement is a marathon, not a sprint. It's a process that demands thoughtful planning, consistent effort, and the willingness to adapt to changing circumstances. Fidelity Investments, a renowned name in the financial services industry, provides a comprehensive suite of retirement planning advice designed to guide individuals through every stage of this critical process. From understanding your current financial standing to projecting future needs and implementing investment strategies, Fidelity offers the resources and expertise to help you build a secure financial future. This advice is particularly crucial in an era characterized by increased life expectancies, rising healthcare costs, and evolving market dynamics. Ignoring these factors can lead to significant shortfalls in retirement savings, potentially jeopardizing your lifestyle and well-being during your golden years. Let's delve into the core elements of what makes Fidelity's approach to retirement planning so effective, and how it can benefit you.

| Category | Details |

|---|---|

| Individual's Name (Hypothetical): | Eleanor Vance |

| Age: | 55 |

| Marital Status: | Married |

| Number of Dependents: | 2 (Husband and a dependent adult child) |

| Current Location: | Denver, Colorado |

| Current Occupation: | Project Manager |

| Industry: | Technology |

| Years in Current Role: | 12 |

| Annual Salary: | $125,000 |

| Employer-Sponsored Retirement Plan: | 401(k) with employer match up to 6% |

| Current 401(k) Balance: | $450,000 |

| Other Investments: | Taxable brokerage account ($100,000), Roth IRA ($75,000) |

| Estimated Retirement Age: | 67 |

| Target Annual Retirement Income: | $80,000 |

| Estimated Social Security Benefit (at age 67): | $30,000 |

| Outstanding Debts: | Mortgage, student loan (dependent child) |

| Health Considerations: | Generally good health, with family history of diabetes |

| Financial Goals: | Retirement, travel, providing for dependent adult child, estate planning |

| Risk Tolerance: | Moderate |

| Link for Reference: | Fidelity Investments Official Website |

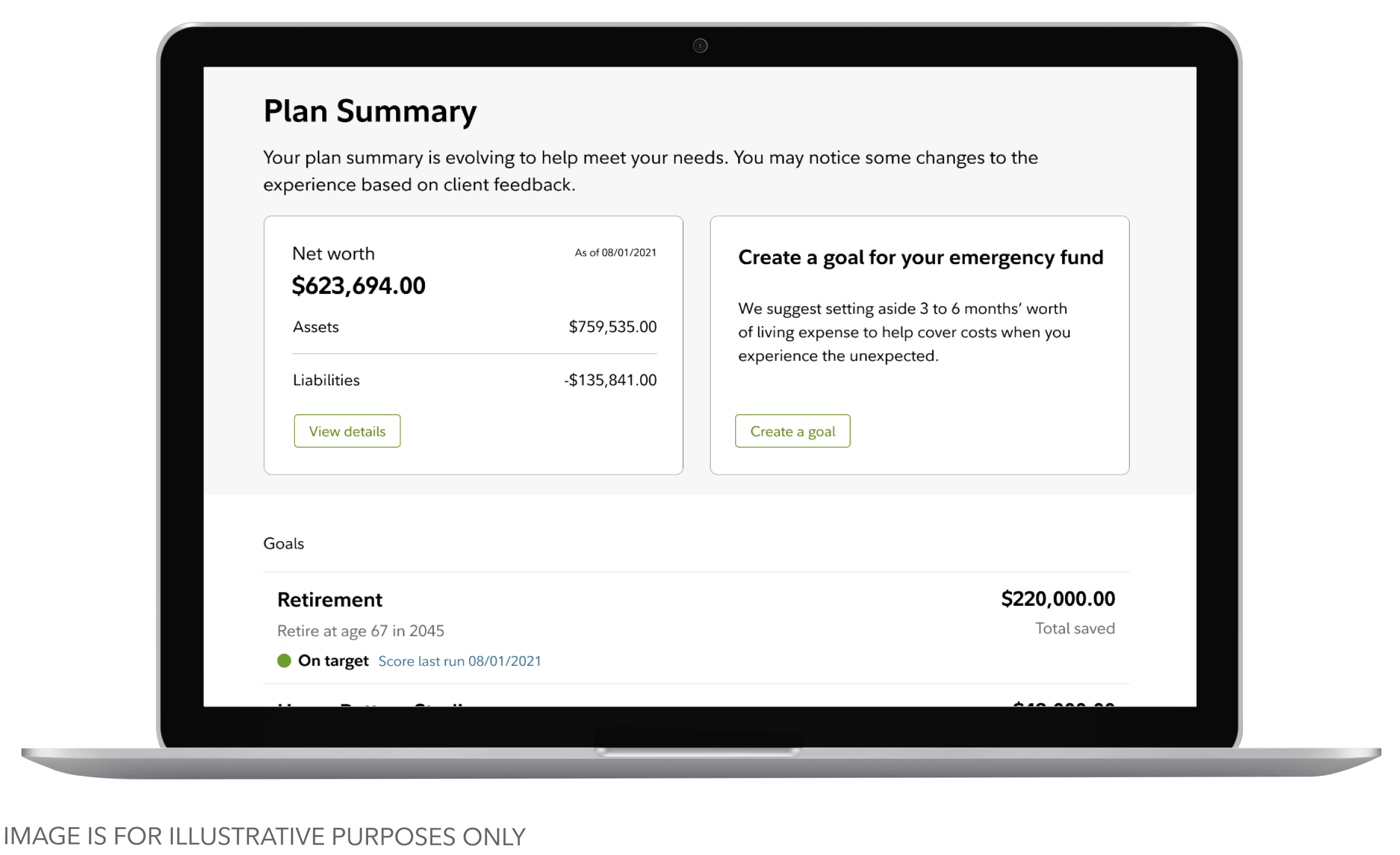

One of the cornerstones of Fidelity's retirement planning approach is a comprehensive assessment of your current financial situation. This involves a thorough review of your assets, liabilities, income, and expenses. By understanding where you stand today, you can build a solid foundation for your retirement plan. This assessment often includes an evaluation of your existing retirement savings, such as 401(k)s, IRAs, and other investment accounts. It also considers any outstanding debts, such as mortgages, student loans, and credit card balances. Furthermore, Fidelity will analyze your current income sources, including your salary, any part-time earnings, and potential government benefits, like Social Security. An important aspect of this process includes projecting your future expenses. These expenses include essential costs like housing, food, healthcare, and transportation. Fidelity helps you estimate these future costs and incorporates them into your overall retirement plan. This detailed financial assessment provides clarity, allowing you to establish realistic goals and make informed decisions about your financial future. Without a clear understanding of your present financial state, it's almost impossible to build a solid retirement plan.

Once the financial assessment is complete, Fidelity assists clients in setting clear and achievable retirement goals. These goals are not just about numbers; they reflect your vision of what you want your retirement to look like. Do you envision traveling the world, pursuing hobbies, or spending more time with family? Fidelity helps you quantify these aspirations, translating them into specific financial targets. These targets, in turn, shape the investment strategies recommended. For instance, if you desire a comfortable lifestyle with significant travel, you'll need to calculate the estimated cost of such activities and incorporate them into your retirement savings goals. This could involve setting a higher annual income target or adjusting your investment strategy to generate more income during retirement. Fidelity professionals provide the tools and resources to help you create these goals, allowing for a much more personalized and effective retirement plan. This process is dynamic and should be regularly reviewed and adjusted as your circumstances change.

Investment strategy is a key component of any effective retirement plan. Fidelity offers a diverse range of investment options, from low-cost index funds to actively managed mutual funds, and individual stocks and bonds. Their approach to investment strategy is highly personalized, considering your individual risk tolerance, time horizon, and financial goals. Risk tolerance is a crucial factor in determining how your assets are allocated. If you are comfortable with more risk, you may be inclined to invest in a portfolio that includes more stocks, which have the potential for higher returns but also carry greater volatility. On the other hand, if you have a low-risk tolerance, you may prefer a more conservative portfolio, with a greater allocation to bonds and cash equivalents. Fidelity will work with you to determine your risk tolerance level and create an investment strategy that aligns with your comfort level. Your time horizon is another critical factor that influences your investment strategy. The longer your time horizon, the more flexibility you have to invest in assets that may experience short-term fluctuations but have the potential for higher returns over the long term. Fidelity will assess your estimated retirement date and use this information to develop an investment strategy that is appropriate for your time horizon. Fidelity also offers a variety of tools and resources to help you monitor and manage your investments. You can track your portfolio's performance online, receive regular statements, and consult with a financial advisor to make necessary adjustments. The goal is not simply to accumulate wealth but to build a diversified portfolio that helps you achieve your financial goals while managing risk.

A crucial aspect of Fidelity's offering is ongoing support and guidance. Retirement planning is not a one-time event; it's an ongoing process that requires regular monitoring, adjustments, and expert advice. Fidelity provides clients with access to a team of experienced financial advisors who are dedicated to helping them navigate the complexities of retirement planning. These advisors are available to answer questions, provide personalized advice, and help you make informed decisions about your investments. Whether you have questions about market trends, tax implications, or estate planning, your advisor is there to provide support. This ongoing support is essential for keeping your retirement plan on track and adapting to changing circumstances. For instance, if you experience a significant life event, such as a job change, a marriage, or the birth of a child, your advisor can help you revise your retirement plan to reflect your new circumstances. Market volatility can also influence your investment decisions. Your advisor can help you weather market fluctuations by providing perspective, offering guidance, and making recommendations to adjust your portfolio as needed. The relationship between a client and a financial advisor is often one of the most valuable components of a retirement planning strategy. Fidelity emphasizes this relationship, allowing its clients to receive the support they need to achieve their financial goals.

Tax planning is an essential, yet often overlooked, aspect of retirement planning. Minimizing your tax liability can significantly impact your retirement savings and the income you receive during retirement. Fidelity offers a variety of resources to help clients navigate the complex world of taxes, including guidance on tax-advantaged retirement accounts, such as 401(k)s and IRAs, and strategies for minimizing taxes on investment gains and withdrawals. One of the primary benefits of tax-advantaged retirement accounts is that they allow you to defer taxes on your earnings until retirement. This can provide significant tax savings over time. Fidelity can help you understand the various tax-advantaged options and determine which ones are best suited for your financial situation. Another key aspect of tax planning is understanding the tax implications of different investment decisions. Fidelity advisors can advise you on how to minimize taxes on your investments, such as by investing in tax-efficient investments and strategically managing your capital gains. As retirement approaches, understanding the tax implications of withdrawals from retirement accounts is crucial. Your Fidelity advisor can help you plan for these withdrawals in a way that minimizes your tax liability and maximizes your retirement income. The ability to take advantage of tax-efficient strategies can significantly improve your financial well-being in retirement.

Estate planning is another critical consideration in the retirement planning process. While retirement planning focuses on your financial security during your lifetime, estate planning is about ensuring that your assets are distributed according to your wishes after your death. Fidelity can provide you with resources and guidance on creating an estate plan, including drafting a will, setting up trusts, and designating beneficiaries for your retirement accounts and other assets. A will is a legal document that specifies how your assets will be distributed after your death. Fidelity can help you understand the importance of having a will and can provide resources for creating one. Trusts are legal arrangements that allow you to transfer assets to a beneficiary while providing greater control over how those assets are managed and distributed. Fidelity can help you understand the different types of trusts and determine whether a trust is appropriate for your estate planning needs. Designating beneficiaries is another crucial step in estate planning. Your beneficiaries will receive the assets in your retirement accounts, life insurance policies, and other assets upon your death. Fidelity can help you understand how to designate beneficiaries and ensure that your wishes are followed. Comprehensive estate planning helps to protect your family and ensures that your assets are distributed in a manner that reflects your values. Proper estate planning, in conjunction with retirement planning, creates a well-rounded financial plan.

Healthcare costs are a significant concern for retirees, and Fidelity recognizes this by offering tools and resources to help clients plan for these expenses. With the rising cost of healthcare, it is essential to factor these expenses into your retirement plan. Fidelity provides clients with access to tools that can help them estimate their future healthcare costs, including the cost of medical care, prescription drugs, and long-term care. These tools help you develop a realistic picture of potential healthcare expenses and plan accordingly. Furthermore, Fidelity offers guidance on various healthcare options, such as Medicare and Medigap plans. Understanding these options is essential for making informed decisions about your healthcare coverage during retirement. Planning for healthcare costs, along with considering other factors like longevity and inflation, is necessary to build a resilient financial plan. Failing to account for these costs can lead to financial stress and difficulty maintaining the desired quality of life during retirement. Fidelity's support with these costs adds significant value to its overall retirement planning services.

Beyond the individual tools and resources, Fidelity offers a wealth of educational materials and resources designed to empower individuals to take control of their financial futures. These materials cover a wide range of topics, from basic investment principles to advanced retirement planning strategies. Accessing these educational resources is often as simple as visiting the Fidelity website or attending a webinar. Fidelity regularly hosts webinars and seminars that provide valuable insights on retirement planning, investment strategies, and other financial topics. These events allow you to learn from financial experts and ask questions in a convenient and interactive setting. Additionally, Fidelity's website features a wealth of articles, calculators, and other educational resources designed to help you learn more about various aspects of retirement planning. These resources can help you understand complex financial concepts, evaluate your investment options, and create a retirement plan that aligns with your goals. Fidelity invests heavily in providing these educational materials, which demonstrates their commitment to helping individuals make informed financial decisions.

In conclusion, Fidelity Retirement Planning Advice offers a comprehensive and personalized approach to retirement preparation. By providing a detailed financial assessment, setting clear retirement goals, providing investment strategies, and providing ongoing support and guidance, Fidelity helps individuals build a secure financial future. Moreover, Fidelity recognizes that tax planning, estate planning, and healthcare costs are essential elements of a sound retirement plan. Through its educational resources and commitment to client service, Fidelity empowers individuals to take control of their financial futures and retire with confidence. In a world where the path to retirement can feel uncertain, Fidelity provides a clear roadmap, guiding individuals every step of the way.